Find out more

Start your journey

to become a

Foster Parent today

At By the Bridge, we believe that it's important that Foster Parents are given not only financial payments that cover the costs of caring for children or young people, but also a professional fee for their work.

Fostering is a great career and our Foster Parents deserve to be rewarded for their hard work like any other worker in the social care or public sector.

Our allowances take into account the demands of Foster parenting and the significance of the role they play in a child or young person’s life.

We know that, although our payments are very competitive, it is impossible to place a monetary value on work that foster parents undertake on a day to day basis.

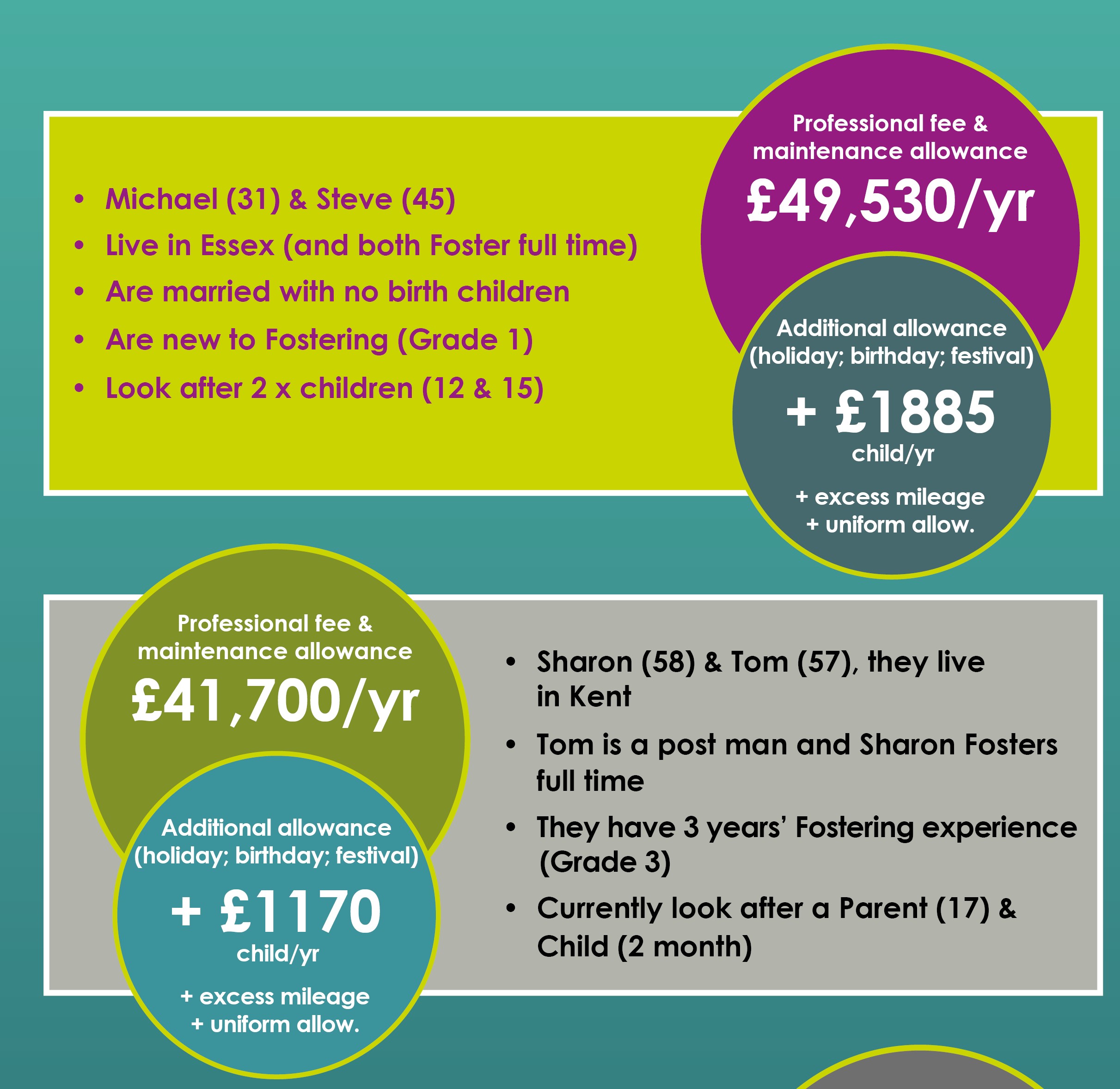

The amount of allowance paid depends on the type of fostering you do with considerations like the age of the child and their individual needs.

The fees we pay to our Foster Parents vary according to the type of Fostering you do. You’ll receive an excellent weekly pay for each Foster child. Typically a Foster Parent could earn from £23,400* a year, tax free, Fostering one child (that's the equivalent of a £29,440* taxed salary).

We would also provide higher professional fees for Foster Children and Young people that require more skilled support:

As well as your professional fee we offer additional allowances, some that are unique to us, that other fostering providers do not. Allowances such as:

Tax Relief for Foster Parents

Foster Parents are classed as self-employed. The government has generous tax allowances in place for those who foster and this means that you will pay little or no tax. As a Foster Parent, with a child in place for the entire tax year, you could receive the equivelant of between £31,400.00 and £34,000.00 in tax relief (depending on the age of the child).

This is made up of:

•A personal allowance of £12,570 plus a fixed rate of £10,000, exclusive to Foster Parents. A total of £22,570.

In addition, a weekly rate of tax relief:

•£200 per week per child under the age of 11 years old

•£250 per week per child aged 11 years old or over

Typically a Foster Parent could earn from £23,400* a year, tax free, Fostering one child (that's the equivalent of a £29,440* taxed salary). As you gain experience and time Fostering, you will move up the pay grades.

If you would like to Foster with By the Bridge, please Contact Us for more information and to begin your Fostering journey.

*based on one child in place for 52 weeks in the 2020/21 tax year.